Latest Updates on IRS where’s My Refund? |Check Status – 2022|

IRS where’s My Refund – Personal taxes are among the biggest source of earnings for any government around the world, including the federal government of the United States. The government requires huge funds to invest in public infrastructure, security, and the welfare of the general public.

We all file our income tax returns each year, and nothing can beat the happiness of getting a refund from an income tax return. Yes, we all understand that feeling when we get some tax refunds.

We have been seeing many ups and downs in the last few years, many of us lost our jobs during the first few waves of COVID-19, but IRS refunds and stimulus checks have been helping us to revive our financial condition.

If you are also expecting an IRS refund, then you are at the right place, as we will discuss everything regarding ‘IRS where’s my refund? I know it is not what time to file your final income tax return, but you should know.

Table of Contents

Why the Sudden Hoax of IRS Refunds?

If you are reading this article, it means you have not received your refund, and you might have heard about the backlog from Internal Revenue Service.

Latest media reports have been suggesting that the Internal Revenue Service has a backlog of millions of income tax returns, and those people are waiting for their refunds.

We all hoped that the Internal Revenue Service would increase its productivity in 2022 as compared to 2020 and 2021, but all those hopes were false as they did not do anything to increase their productivity.

At the end of October 2022, the Internal Revenue Service had a backlog of eight million unprocessed paper returns, whereas they only had seven million paper tax returns in October 2021.

Congress might have allotted $80 billion for the Internal Revenue Service to increase its operations and team, but we do not see any positive results.

The federal government does not want any more bad publicity against them. The Ukraine war and COVID-19 have done enough damage to general Americans. Rising inflation and no jobs are putting pressure on Americans to cut the budget, and these refund delays further increase their problems.

Simple Steps to Find IRS where’s My Refund

Before we move ahead, let’s take a look at the tool to check your refund status. Don’t worry. We are going to use the official website of the Internal Revenue Service, and the tool is launched by the IRS itself.

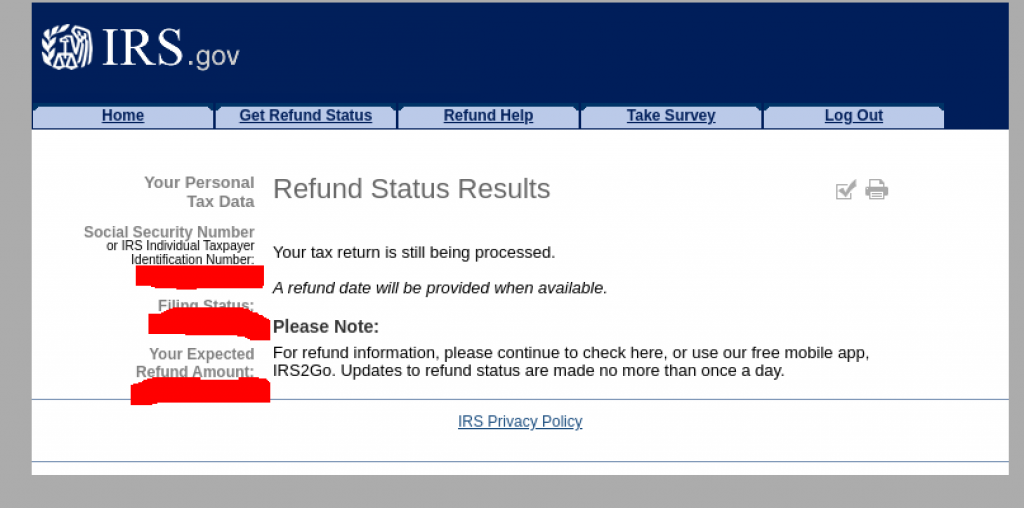

To check your refund status, you will require your filing status, your exact refund amount, and your Social Security number or ITIN. Kindly get ready with your details to find your refund status.

- To check your IRS refund, simply click on the above-given button to reach the official website of the Internal Revenue Service.

- The button will further redirect you to the IRS refund page, where you will have to scroll a little bit down and find a button named check my refund status.

- Once you have located the check my refund status button, kindly click on it, which will take you to the next place where you will have to enter some information.

- First of all, the tool will ask you to select the year you want to check. Usually, people can check the last three tax filings. By that logic, you will be able to check your 2019, 2020, and 2021 returns.

- Once you have filled in that information, then it will ask you to enter your Social Security number along with your filing status.

- Your filing status will be about your marital status. If you have recently married, But you have not informed the Internal Revenue Service, then you should select single.

- Lastly, the tool will ask you about the exact whole amount you are asking for a refund. Make sure you have counted the money correctly for the refund and enter that amount only.

Apart from the website, you can also use the official application of the Internal Revenue Service to find your refund. Recently, the Internal Revenue Service lost its portal in the form of a mobile application and named it IRS2go.

Anyone can download it from any major mobile application platform, including Google Play store, Apple App store, and Amazon marketplace. You can simply search for it in those marketplaces and download it to track your refund status, direct payment, and tax-free help.

The whole application is completely free to use, so you don’t have to pay anything to get assistance. At the same time, your information will be safe with the department itself.

When Should you Contact the IRS for Your Refund?

As you are already aware, most private and government organizations in the world take some days to clear the process and initiate any spending.

A similar thing is also happening with the Internal Revenue Service, as they do not issue the refund as soon as you file your income tax return. The IRS is going to take some days to initiate your refund.

If you have not received your tax refund and you want to contact the Internal Revenue Service for the same, then you should follow the below-given guidelines. If you are fulfilling the below-given criteria, then you can use their toll-free numbers to contact them.

The time frame to contact the Internal Revenue Service can be different depending on the mode and other eligibility criteria.

- Everyone must wait at least 21 days after E-filing their tax return before contacting the Internal Revenue Service for a refund.

- Everyone must wait at least six months after mailing the paper return.

- There must not be any mistakes in your tax filing.

If you believe you follow the above-given criteria, then you are free to contact the Internal Revenue Service anytime you want for a refund. Kindly remember, if you are contacting the Internal Revenue Service for a refund 21 days after e-filing and six months after paper filing, Then IRS won’t be able to help you.

Major Reasons for not Receiving a Refund

If you have filed your income tax return and waited for 21 days or six months, depending on the mode, it doesn’t mean that you will receive a refund no matter what.

There can be hundreds of different reasons you might not be getting your refund, and you should understand all those before you start calling the Internal Revenue Service. We highly recommend everyone create at least two to three Xerox copies of their income tax return before filing it.

A Xerox copy of your return will help you find the mistake if you have made any. Usually, people who file their income tax return by paper might have to wait more time than a person who uses the E-filing process.

- If you haven’t mentioned any incorrect recovery rebate credit amount, then it might take longer for the Internal Revenue Service to rectify the mistake and issue a refund.

- If you have requested any wrong tax credit, then it might also take longer for the Internal Revenue Service to issue the refund.

- If your income tax filing is not complete and you are missing any documents, then you might not be able to receive your refund.

- If you have recently experienced any fraud or identity theft, then it might also take longer to process your refund request.

- People who are requesting an older refund might also have to wait for a longer period.

No matter what, you should not refile your tax return under any circumstances. If you are not receiving your tax refund, it doesn’t mean that you should refile your whole tax return once again. Yes, you can amend your old income tax filing, but refiling it is not the solution.

Is the IRS refunding free money?

No, an IRS refund is never going to be free money, and it is a huge misconception among most taxpayers. A refund is never going to be free money. We all pay taxes throughout the year, and a refund is just the money we have paid extra to the government. You can think of it as a bonus, but it is never going to be free money.

My income tax return was right, but I have not received any refund. What should I do?

As you might already know, the Internal Revenue Service has more than 8 million income tax returns in its backlog. People who have filed their income tax returns with paper filing might have to wait a little bit longer for their tax refunds.